By Ghislain De Rengervé – Helma International

Many companies assess the cost of an international assignment by using the components of the expatriate compensation package as a basis of their calculation. The components typically include: assignment salary, premium allowances and benefits in kind, costs related to Global Mobility providers such as Immigration services, Household Goods Management or Destination services.

Very often, the tax burden of all the benefits is not taken into consideration. Yet, international taxation of your assignees may have a strong impact on the costs incurred for your company and possibly for your employees too, depending on the destination.

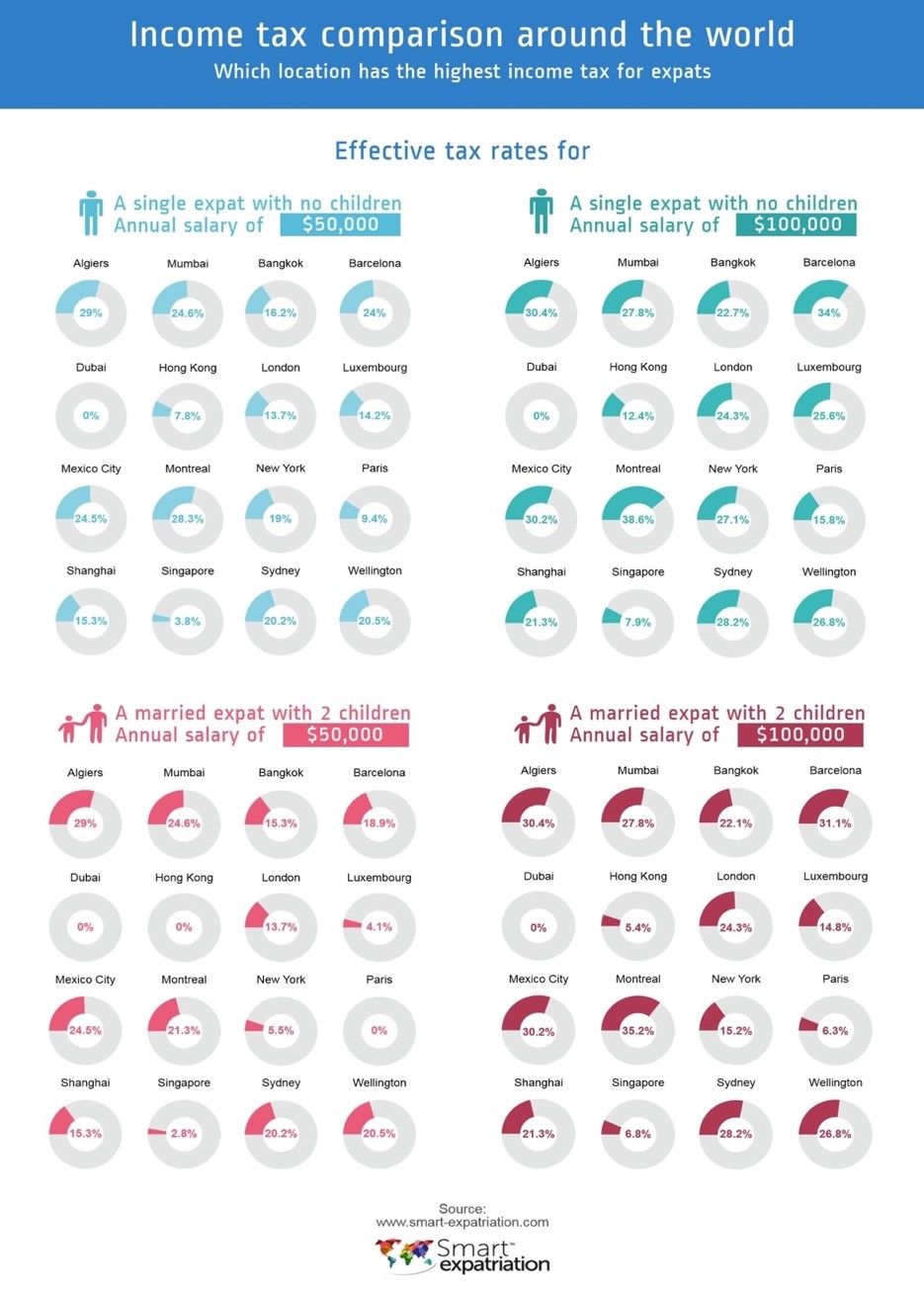

In this article, we invite you to compare average tax rates on a foreign employees’ income in the top 16 cities requested by users on Smart Expatriation

Picture caption:

Infographic based on Smart Expatriation data that demonstrates the calculations for two different salary brackets and two family types. The automated tax calculation is based on the income earned by an individual, taking into account all tax benefits schemes that are systematically applicable in the country such as social contributions, business expenses, dependents, etc., and excluding any tax optimization.

These are the right four questions to ask in order to anticipate the costs of income tax:

1. Where do you send your employees on assignment?

Ranging from 0% to 38.6 %, the applicable tax rates vary significantly from one location to another. Cities like Montreal, Algiers and Barcelona have particularly high tax percentages irrespective of the marital status or level of remuneration. On the contrary in most Middle Eastern countries, foreign assignees are exempt from income tax payment, for example in Dubai. Whereas, not surprisingly, the two major hubs in Asia, Hong Kong and Singapore, offer attractive income tax policies.

Taxes can also be imposed according to the place of residence in the country. The United States can be taken as a reference, where tax burden rules vary widely from one State to another.

2. How many dependents is the assignee allowed during his foreign assignment?

Some countries tend to favor families due to existing family tax benefits or a tax-free household allowance plan (such as the policy applicable in France). Thus, for the same wage level, a married assignee with two children would significantly pay less tax than a single person.

These benefits are often missed out while considering taxable income: half of the cities featured in this graphic do not consider family status for tax computation: for exemple London, Shanghai and Sydney.

3. What compensation do you offer your assignees?

The tax analysis for a country cannot be limited only to the calculation of average tax rates. The actual level of taxation is assessed in detail by taking into account the progressive tax system and all tax benefits schemes applicable in the country.

Let’s focus on Hong Kong: while the average tax rate may seem low at first (from 0 to 12.4% depending on cases, see graphic), if the net annual income is higher than $15,500 it is taxed at 17%.

In Montreal, the tax brackets start from the first Canadian Dollar progressing at a rate up to 25.75 % applied to the highest income bracket. This system particularly weighs on the total average tax.

Other reasons impact tax levies. In the province of Quebec, social contributions are not deductible which leads to a higher taxable income compared to other locations. Only the imputation of credits can reduce the amount of tax, which remains however high.

4. How about tax optimization?

Calculating income tax on the earnings of your assignees is a good basis for calculation. However, the estimate does not replace the detailed analysis of a tax specialist who will analyze the individual situation in order to optimize the overall tax costs of the compensation package.

With this in mind, advice and recommendations on best practices to be implemented for tax optimization should be based on: offering the best tax optimization solutions and presenting a fair and attractive compensation to your assignees.

Finally, if the income tax does not tend to be excessive in some countries, do not let yourselves be taken by surprise by the employer-employee social contributions amounts. Mandatory contributions can amount to significant payments.

Please sign in or register for FREE

Sign in OR sign up to become a registered The Forum for Expatriate Management website user

Subscribe here