NON-RESIDENT TAXES APPLICABLE IN SPAIN

Tax residents in Spain are liable to pay taxes in the country for its worldwide income obtained during a tax year.

However, the obligation regarding taxes does not stop just for tax residents in the territory, the non-tax residents who have wealth in the Spanish country may have the obligation as well to submit tax returns and pay taxes under the Spanish non-resident regulations.

This is something that needs to be considered in the general context of expatriation or posting of employees, which could include a change of tax residency.

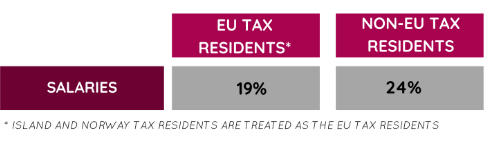

Real estate, investments, salaries, or pensions are some of the income that could be taxable in Spain for non-residents, at the general tax rate of 24%, although the tax rate may vary depending on the income specifics and the country of tax residency.

The most usual situation is the non-resident who has a property in Spain. The real estate taxation for non-residents in Spain follows the rules stated below, differing if the real estate is rented or not:

.png)

Note that after Brexit, the UK is now considered as a third country, with the consequent increase of taxes for the tax residents there who have a property in Spain.

At ExpatFeliu we will evaluate your case in detail.

Contact us for further information.

Please sign in or register for FREE

Sign in OR sign up to become a registered The Forum for Expatriate Management website user

Subscribe here