Tax Rates in Emerging and Developed Economies for Mobility Programs

Author: Pat Jurgens, Director of Global Tax Research and Consulting at AIRINC

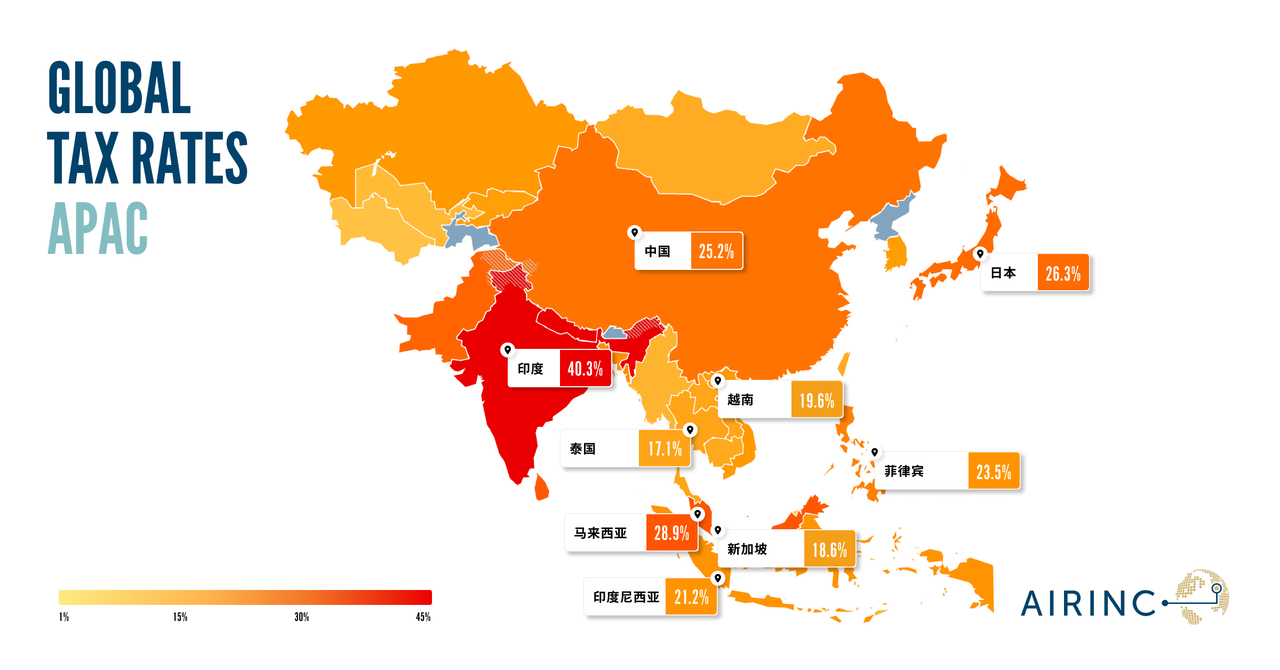

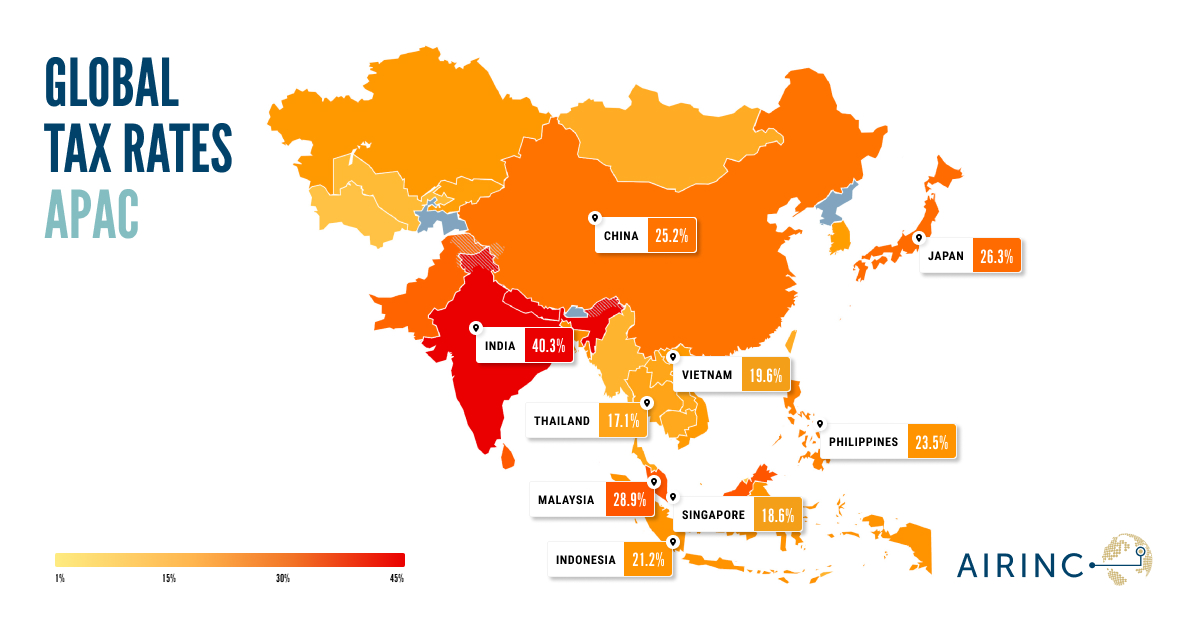

So far in our blog AIRSHARE, we’ve examined Europe, the Middle East, and Africa—highlighting the contrasts between high-tax Nordic nations, tax-free Gulf states, and the diversity of systems across the African continent. Now, we turn our attention to the dynamic APAC region.

Discovering APAC Through the Tax Rates Map

The APAC Tax Rates map showcases a region of contrasts. Developed nations like Japan have higher effective tax rates, while emerging markets such as Vietnam and the Philippines present lighter tax burdens. Whether you’re managing mobility programs or dreaming of working abroad, this map offers a visually engaging way to explore the region’s tax diversity.

How APAC’s Map Impacts Global Mobility

- High Taxes in Developed Economies: Japan stand out on the Rates map for their robust tax systems, funded by comprehensive public services. Mobility teams should budget for allowances and reimbursements to offset the burden.

- Low Taxes in Emerging Markets: Countries like Vietnam and the Philippines shine on the map as low-tax regions, but limited social safety nets require companies to provide additional benefits.

- Singapore and Hong Kong Incentives: The Rates map highlights these jurisdictions as tax havens, making them attractive for both assignees and businesses.

Upcoming Tax Changes in APAC

- Malaysia’s Employee Provident Fund: The government has approved mandatory contributions to the Employee Provident Fund (EPF) for foreign employees. Previously, foreign nationals were exempt from mandatory EPF contributions but could contribute voluntarily. Starting later in 2025, EPF contributions will become mandatory for foreign employees at a rate of 2%, applicable to both employees and employers. The implementation date has not yet been announced. As Malaysia does not currently have any totalization agreements in force, this change will increase costs for inbound assignments.

- Vietnam Tax Reform: The Vietnam Ministry of Finance (MOF) has announced plans to introduce tax amendments effective from 2026. Proposed changes include reducing the number of tax rates and brackets applied to salaries and wages, as well as modifying family deductions. The MOF has launched a public consultation to gather feedback on the proposed amendments. We will provide updates as new developments emerge.

- Indonesia taxation of benefits in kind: New tax regulations have been issued concerning non-cash benefits in kind (BIK). Previously, most BIK were neither deductible for the employer nor taxable to the employee. Under the new regulations, BIK are generally taxable to employees and deductible for employers. Limited exceptions apply, including benefits related to food and beverages, BIK associated with employment in remote hardship areas, uniforms or safety equipment, and those provided by government-paying entities. Taxable BIK are now subject to withholding tax, and if the employer bears the tax on BIK, the tax is subject to gross-up.

Conclusion: Rates Maps, Taxes, and Global Mobility

Tax Rates maps do more than just display numbers—they tell stories about how regions prioritize public welfare and individual income. Whether you’re a global mobility professional or someone curious about how taxes shape our world, this series is your go-to resource.

Why Choose AIRINC?

AIRINC’s tax solutions are designed to address the multifaceted challenges of global mobility programs. Their combination of accurate data, strategic insights, and tailored advisory services empowers organizations to manage costs, ensure compliance, and maintain employee satisfaction. Whether dealing with tax equalization, planning assignments, or adapting to tax law changes, AIRINC delivers the expertise and tools to succeed in a globalized world.

Look Out for the Next Blog!

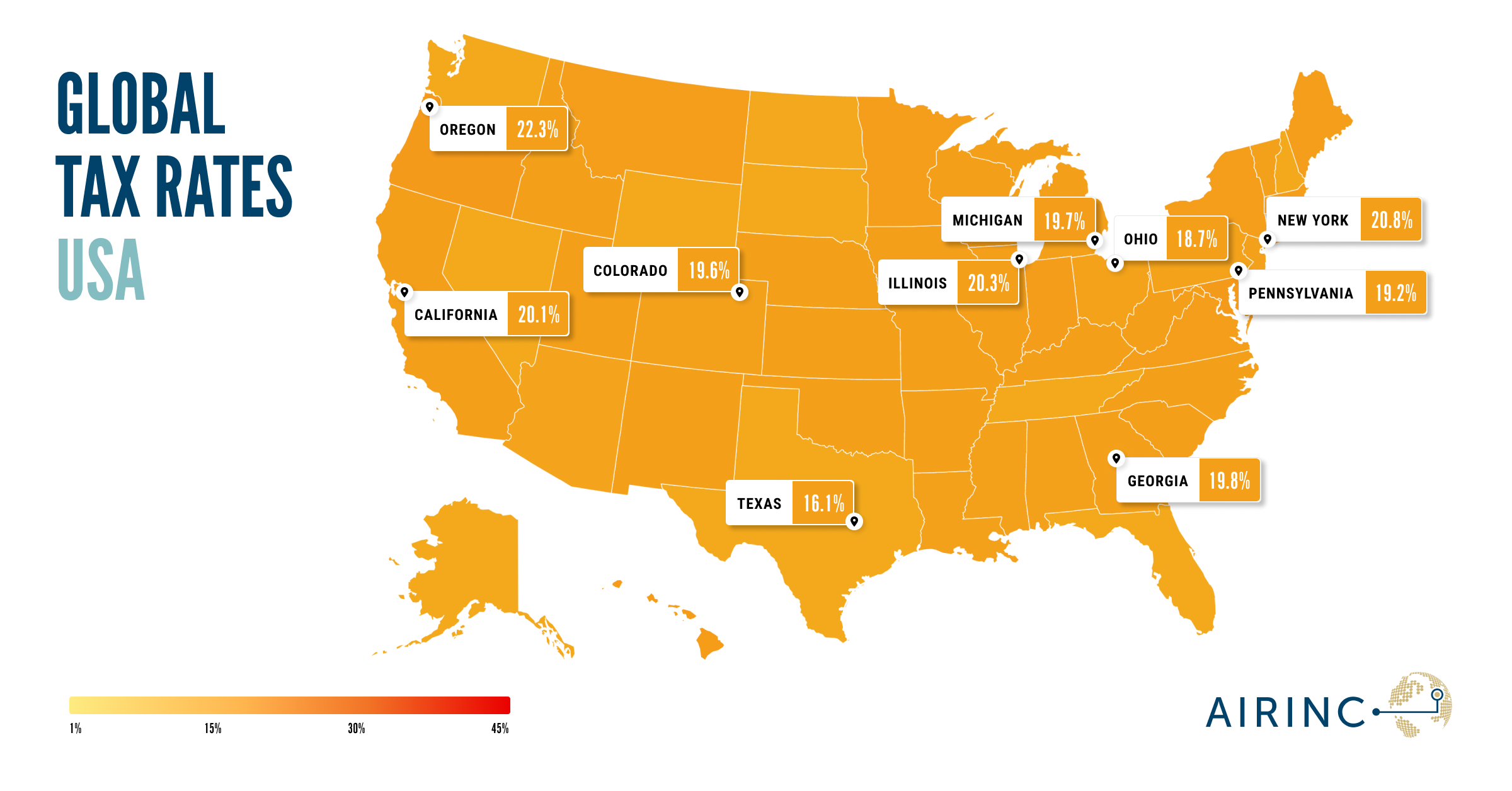

Look Out for the Next Blog! Subscribe to see our next blog where we will explore the unique complexities of the U.S. tax system.

Are you looking for information on global tax rates around the world?

AIRINC’s International Tax Guide contains all of the information you need to support your assignment tax planning — including global tax rates, deductions, and employee/employer social security contributions.

Are you trying to move an employee from a lower- to a higher-tax rate location?

Use AIRINC’s Global Salary Comparison to understand the compensation you would need to offer to cover the difference and make the appropriate offer to your employee.

Want to hear even more on tax?!

Coming up on May 22, our next Global Tax Chat show. Join us for an around-the-world round-up of international Mobility Tax developments. We'll also put our tax goggles on for a dive into U.S. tax legislation, the IRS, and tariffs! Register here.

Please sign in or register for FREE

Sign in OR sign up to become a registered The Forum for Expatriate Management website user

Subscribe here